Name Screening

Ensure fast, accurate, and hassle-free name screening with Idenfo Direct. Our AI-powered name screening solution helps businesses stay compliant by detecting risks in real-time, minimizing false positives, and streamlining KYC name screening and AML name screening processes.

What is Name Screening?

Name screening is a vital process within KYC compliance tools and AML compliance solutions that verifies individuals and entities against global watchlists to prevent financial crime. It plays a key role in financial crime prevention by identifying high-risk profiles such as politically exposed persons (PEPs) and sanctioned individuals. For regulated businesses and financial institutions, effective name screening solutions ensure adherence to regulatory requirements and reduce the risk of onboarding fraudulent or high-risk customers.

Core Features of Our Name Screening Solution

AI-Powered Risk Detection

Advanced machine learning algorithms enable precise real-time risk detection with reduced false positives, improving accuracy in KYC name screening and AML name screening.

Real-Time Screening

Instantly screen against global sanctions lists, PEP databases, and adverse media sources for comprehensive AML compliance.

Advanced Adverse Media Monitoring

Continuously scan worldwide news and social media to detect negative information impacting customer risk profiles.

Fuzzy Matching Algorithms

Intelligent name matching accounts for spelling variations, cultural differences, and typographical errors to catch aliases and similar names.

Benefits of Using Idenfo Direct’s Name Screening

Enhanced Regulatory Compliance

Meet global and regional AML and KYC regulations with our robust name screening and AML compliance solutions.

Financial Crime Prevention

Protect your business from fraud, money laundering, and terrorist financing through continuous and effective screening.

Streamlined KYC and AML Workflows

Automate manual processes and reduce onboarding time with our real-time name screening for financial institutions.

Continuous Monitoring for Compliance

Stay updated with real-time alerts on changes to customer risk profiles and sanctions list updates.

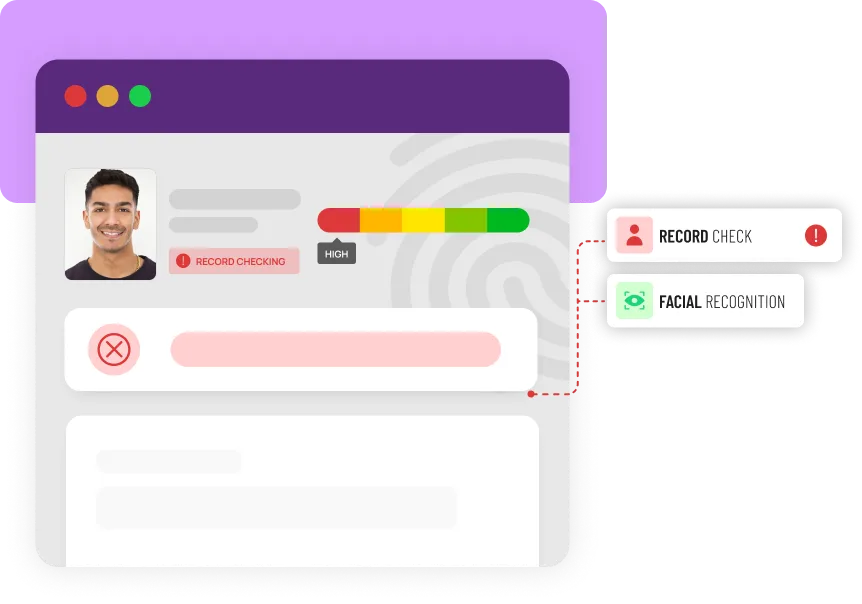

How It Works: Step-by-Step Process

Data Input

Collect customer information such as name, date of birth, nationality, and other identifiers.

Automated Screening

Cross-check data against global sanctions lists, PEP databases, and adverse media sources using our AI-powered name screening technology.

Risk Scoring and Alerts

Assign risk levels based on multiple factors and generate alerts for potential matches or high-risk entities.

Integration

Seamlessly integrate screening results with your existing KYC compliance tools and AML monitoring systems via API.

Industry Use Cases

Banking and Financial Services

Conduct thorough KYC name screening to onboard corporate and retail clients securely.

Fintech and Payment Processors

Automate AML name screening for merchants and customers to prevent fraud and comply with regulations.

Insurance Companies

Use business identity authentication and name screening to mitigate underwriting risks.

Legal and Consulting Firms

Perform comprehensive business due diligence and background checks on clients and partners.

Types of Screening Offered

- Politically Exposed Persons Screening: Identify and assess risks related to PEPs and their close associates using up-to-date global databases.

- Sanctions List Screening Software: Screen customers against international and regional sanctions lists, including OFAC, UN, EU, and local MENA sanctions.

- Adverse Media Screening: Monitor negative news and media coverage to detect reputational risks and potential compliance issues.

Integration and API Capabilities

- Seamless API Integration: Embed our name screening solution into your onboarding and compliance workflows for real-time verification.

- Customizable Workflows: Tailor screening parameters and reporting to fit your specific regulatory and operational needs.

- Audit-Ready Reporting: Maintain detailed logs and compliance reports to support regulatory audits and internal reviews.

Compliance and Regulatory Standards

- Global AML and KYC Alignment: Our solution supports compliance with FATF recommendations, EU AML directives, UAE PDPL, and other regional laws.

- Data Privacy and Security: We implement industry-leading encryption and data protection standards to safeguard customer information.

- Continuous List Updates: Sanctions, PEP, and adverse media lists are updated regularly to ensure the most current data is used.

Frequently Asked Questions

What lists are included in sanctions screening?

Our sanctions list screening software covers OFAC, UN, EU, UK HM Treasury, UAE Central Bank, and other global and regional watchlists.

How often is the data updated?

Our databases refresh hourly, with real-time updates for sanctions and adverse media sources.

How does AI reduce false positives in name screening?

Our AI-powered name screening uses machine learning to analyze historical data and improve fuzzy matching algorithms, significantly reducing false positives while maintaining high detection accuracy.

What industries benefit most from name screening?

Banking, fintech, insurance, legal, and any regulated industries handling high-risk transactions rely heavily on comprehensive name screening for regulatory compliance.

Ready to See It in Action?

Ready to enhance your compliance with our advanced name screening solution?

[Book a demo] or [contact us] to learn how our real-time name screening for financial institutions can protect your business and streamline your AML and KYC processes.